Wikipedia's glocalization page notes:

"Glocalization (a portmanteau of globalization and localization) is the adaptation of international products around the particularities of a local culture in which they are sold. The process allows integration of local markets into world markets.

The term first appeared in a late 1980s publication of the Harvard Business Review. At a 1997 conference on "Globalization and Indigenous Culture", sociologist Roland Robertson stated that glocalization “means the simultaneity – the co-presence – of both universalizing and particularizing tendencies.”"

An intellectually honest treatment of intralesional or intratumoral delivery of immunotherapy frames the work of more than 100 years ago of Dr. William Coley, MD, "now considered the “Father of Cancer Immunotherapy”" in terms of

both route of delivery (intralesional or intratumoral, as opposed to orally or intravenously),

and what is delivered (dead bacteria).

See

Do Dr. Jedd Wolchok/Sloan Kettering Understand Immunotherapy's History? (July 12, 2016) on

the blog's Archived News VI page.

It would appear that Memorial Sloan Kettering Cancer Center (MSKCC) recently (i.e., that is 2015, perhaps earlier) embraced the history of the medical institution's involvement with harnessing the immune system to fight and treat cancer by describing the work of Dr. William Coley, MD, "now considered the “Father of Cancer Immunotherapy,”" on its website. See MSKCC webpage

"Immunotherapy: Revolutionizing Cancer Treatment since 1891." Dr. Coley began his career as a bone surgeon at New York Cancer Hospital, which later became part of MSKCC.

When writing about immunotherapy, and usually pointing to Bristol-Myers' anti-CTLA-4 drug ipilimumab (Yervoy) and/or anti-PD-1 drugs pembrolizumab (Merck & Co., Keytruda) and nivolumab (Bristol-Myers, Opdivo), many mainstream media and medical writers and journalists often include in their introduction descriptions of Dr. Coley's work. I think it makes for a good story, as the writers endeavor to link history, and descriptions and lessons from the past, to the present day, and potentially our future.

MSKCC says Dr. Coley's work "paved the way for the modern immunotherapies that are helping patients today."

Route of delivery matters. Dr. Coley's work, and his approach to treatment, comprise two key feature, one of which nearly all who write about him (but not everyone) routinely ignore, conflating his discoveries, observations and conclusions with drugs incapable of delivering what he experimented with in order to seek better patient outcomes.

Coley's approach to the treatment of cancer was composed of (a)

a "drug compound," the heated-killed bacteria known as Coley’s toxins whose actions following treatment somehow engaged the immune system (e.g., fever), and (b)

the route of administration by injection of the dead bacteria into the patient's tumors.

The key feature of Coley's work that is ignored, conflated, confused or misunderstood: the manner in which the drug, drug compound, biologic or small molecule is delivered. Yervoy, Keytruda and Opdivo are immunotherapies that are intravenously administered to patients; they are

not injected into patient tumors.

Google "Wolchok" and "Coley," and thousands of results are returned.

MSKCC's Dr. Jeff Wolchok, a medical oncologist, apparently uses Coley's story when he (Dr. Wolchok) explains immunotherapy. Dr. Wolchok, holder of MSKCC's Lloyd J. Old Chair for Clinical Investigation, was a student of

Dr. Lloyd Old, MD, who (according to Memorial Sloan Kettering):

"...did some of the first modern research on immunotherapy, with a substance called BCG, now an FDA-approved treatment for bladder cancer. BCG is made from a weakened version of the bacterium that causes tuberculosis. Experts think Coley’s toxins may have worked in a similar manner to BCG — jumpstarting an immune response to cancer by provoking one against the bacteria."

This work of Dr. Old appears to be during the 1950s. For example, see

"Effect of Bacillus Calmette-Guérin Infection on Transplanted Tumours in the Mouse." Who am I to say or write this, but perhaps Dr. Old was focused on one of the two key features, the use of a biologic (i.e., the "drug compound") to engage the immune system. He may have ignored Coley's work's other feature, route of delivery.

The administration of BCG (aka Bacillus Calmette-Guérin) for bladder cancer is intravesical, which means it is

"put directly into the bladder through a catheter, instead of being injected into a vein or swallowed." See the illustration below.

Intravesical, like intravenous is

not injection into the tumor (i.e., intralesional, intratumoral).

Ironically, the second aspect of Coley's work, route of delivery, was explored in the 1970s with BCG (or BCG immunotherapy) in metastatic melanoma when the drug was it was directly injected into metastatic melanoma lesions limited to the skin; see, for example,

"BCG Immunotherapy of Malignant Melanoma: Summary of a Seven-year Experience." Unfortunately, the immunotherapy failed a Phase 3 trial; see 2004 paper

"Mature results of a phase III randomized trial of bacillus Calmette–Guerin (BCG) versus observation and BCG plus dacarbazine versus BCG in the adjuvant therapy of American Joint Committee on Cancer Stage I–III melanoma (E1673):"

"In what to our knowledge is the largest ever trial to test the role of BCG as adjuvant therapy for melanoma, no benefit for BCG was observed for patients with AJCC Stage I–III disease. The mature results of the current trial projected to 30 years confirmed the negative results of previous smaller studies utilizing this agent."

What does Dr. Coley's work tell us about how to treat cancer via immunotherapy? Is it about the drug compound? Is it about the route of administration? Or, as I believe (because of Rose Bengal), is it both?

Consider April 2016's

"Germ of an Idea: William Coley's Cancer-Killing Toxins", which more appropriately places Dr. Coley's work into context:

"That was all Coley needed to proceed directly to human trials, and Zola would become his first test subject. Coley filled a syringe with living Streptococcus pyogenes, known to induce erysipelas attacks, and injected the solution directly into Zola’s tumor. It took awhile — in fact, it took repeated injections over five months — but finally, an hour after one particular injection in October, Zola broke out into sweaty chills, and his body temperature soared to 105 degrees...

“Coley injected his first patient a century ago, and what he saw was almost identical to what we saw in our first patient,” says Saurabh Saha, a partner with Atlas Venture, former BioMed Valley researcher and senior author of the study...”

C. novyi is really a two-pronged weapon against cancer: It germinates in tumors and releases cancer-killing enzymes, and it may also trigger an immune response similar to Coley’s Toxin. Since C. novyi survives only in oxygen-poor environments — tumors can be notoriously void of oxygen — the bacteria die when they reach healthy, oxygen-rich tissues, sparing collateral damage. Essentially, the injections perform highly precise biosurgery from the inside out."

Updated (7/31/16): Does The New York Times understand cancer immunotherapy's history? The NYT's Denise Grady wrote

"Harnessing the Immune System to Fight Cancer" on July 30th. In it she references Dr. Coley's name 18 times, and presumably uses his work as a vehicle to discuss Dr. James Allison's immune checkpoint inhibitor work. Interestingly, this author, while invoking Coley's biologic material he injected into patients, does not mention the route of delivery Coley used. She uses the verb "inject," but does not say where:

"Dr. Coley began to inject terminally ill cancer patients with Streptococcal bacteria in the 1890s. His first patient, a drug addict with an advanced sarcoma, was expected to die within weeks, but the disease went into remission and he lived eight years.

Dr. Coley treated other patients, with mixed results. Some tumors regressed, but sometimes the bacteria caused infections that went out of control. Dr. Coley developed an extract of heat-killed bacteria that came to be called Coley’s mixed toxins, and he treated hundreds of patients over several decades. Many became quite ill, with shaking chills and raging fevers. But some were cured."

Ironically, she references radiation, which is making a resurgence because of the growing understanding/belief that local treatments to/on tumors may unlock the gateway to the immune system's reaction around the body:

"Early in the 20th century, radiation treatment came into use. Its results were more predictable, and the cancer establishment began turning away from Coley’s toxins. Dr. Coley’s own institution, Memorial Hospital (now Memorial Sloan Kettering Cancer Center) instituted a policy in 1915 stating that inpatients had to be given radiation, not the toxins. Some other hospitals continued using them, but interest gradually waned. Dr. Coley died in 1936."

See, for example, June 2015's

"June Podcast: The Abscopal Effect with Sandra Demaria."

Finally, it is interesting to note that Allison, Wolchok and others submitted a patent application (published in 2014) for

the use of an oncolytic virus with immune checkpoint inhibitors via the injection of the virus into tumors.

Which brings us back to glocalization in cancer treatment...

H/t

@bradpalm1:

|

| Click to enlarge. |

Abstract:

Immune mechanisms have evolved to cope with local entry of microbes acting in a confined fashion but eventually inducing systemic immune memory. Indeed, in situ delivery of a number of agents into tumors can mimic in the malignant tissue the phenomena that control intracellular infection leading to the killing of infected cells. Vascular endothelium activation and lymphocyte attraction, together with dendritic cell–mediated cross-priming, are the key elements. Intratumoral therapy with pathogen-associated molecular patterns or recombinant viruses is being tested in the clinic. Cell therapies can be also delivered intratumorally, including infusion of autologous dendritic cells and even tumor-reactive T lymphocytes. Intralesional virotherapy with an HSV vector expressing GM-CSF has been recently approved by the Food and Drug Administration for the treatment of unresectable melanoma. Immunomodulatory monoclonal Abs have also been successfully applied intratumorally in animal models. Local delivery means less systemic toxicity while focusing the immune response on the malignancy and the affected draining lymph nodes. The Journal of Immunology, 2017, 198: 31–39.

"Intratumoral Delivery of Immunotherapy-Act Locally, Think Globally," Aznar et al.,

J Immunol. 2017 Jan 1;198(1):31-39.

The article does not mention or reference PV-10. Nevertheless, the notion of concept of local delivery of immunotherapy is important, and the authors do reference oncolytic virus (OV) immunotherapy or oncolytic immunotherapy T-Vec -- "Intralesional virotherapy with an HSV vector expressing GM-CSF has been recently approved by the Food and Drug Administration for the treatment of unresectable melanoma."

The introduction of the article frames Coley's work in context:

"More than 100 years ago, the surgeon William Coley found that in some cases of soft tissue sarcoma there were regressions following erysipelas. Facing similar cases in his practice, he proceeded to cause such risky infections on purpose, observing some successful responses. To make it safer he went on to use bacterial-derived material (Coley’s toxins) to locally inject tumor masses. Since then, we have learned that the results obtained by Coley were related to a systemic antitumor immune response following local delivery of the ill-defined microorganisms and bacterial toxins."

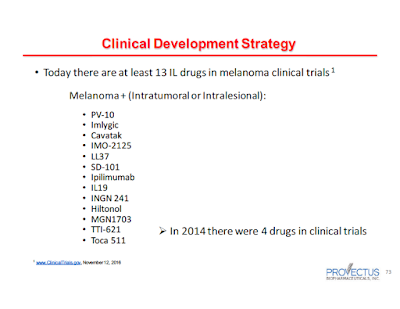

Provectus CTO Dr. Eric Wachter, PhD noted the interest in the field of intralesionally delivered cancer medicines in

his November 14th slide presentation:

|

| Click to enlarge |

The challenge or opportunity for intralesional or intratumoral delivery, however, is the beneficial power -- both breadth and depth -- of the immunological signalling generated subsequent to tumor injection with the compound in question.

Aznar et al. note as much:

"There are a number of immune mechanisms to be exploited by local delivery that would mimic infection by a pathogen (Fig. 1). The key aspect is that local intervention needs to exert systemic effects against distant metastases based on lymphocyte recirculation. The difficulty in achieving systemic effects would depend on factors such as proximity, similar lymphatic drainage, vascularization or truly anatomical distance. In tumor vaccination, it has been observed that the site of priming imprints recirculation patterns to T cells. This cellular behavior is dependent on chemokine and tissue homing receptors. Interestingly, DCs in each territory imprint the pattern of recirculation receptors to the T cells that they prime by cognate Ag presentation."

|

| Click to enlarge. Part 1 of 2 of full image. Figure 1, Aznar et al. |

|

| Click to enlarge. Part 2 of 2 of full image. Figure 1, Aznar et al. |